USDT achieved multiple new highs in the fourth quarter of 2025, as follows:

· Market capitalization reached $187.3 billion;

· Achieved over 30 million new users for the eighth consecutive quarter;

· Recorded the largest quarterly increase in the number of on-chain wallets holding USDT;

· Monthly active on-chain users reached an all-time high;

· Both the number and value of on-chain transfers hit record levels.

Meanwhile, a chain reaction of cryptocurrency liquidations that occurred on October 10, 2025, has led to a slowdown in the growth rate of the stablecoin ecosystem. Between October 10, 2025, and February 1, 2026, the total cryptocurrency market capitalization fell by over one-third. During this period, the market cap of USDT grew by 3.5%; in contrast, the market caps of the second and third largest stablecoins fell by 2.6% and 57%, respectively.

The sustained growth of USDT relies not only on the cryptocurrency market but also on various use cases beyond it. Data clearly shows that users prefer USDT as a stablecoin for both storing wealth and conducting transactions.

These conclusions are primarily based on Tether's analysis of blockchain data (also known as on-chain data). On-chain data for 75 stablecoins across 15 blockchains were sourced from Chainalysis and Artemis.

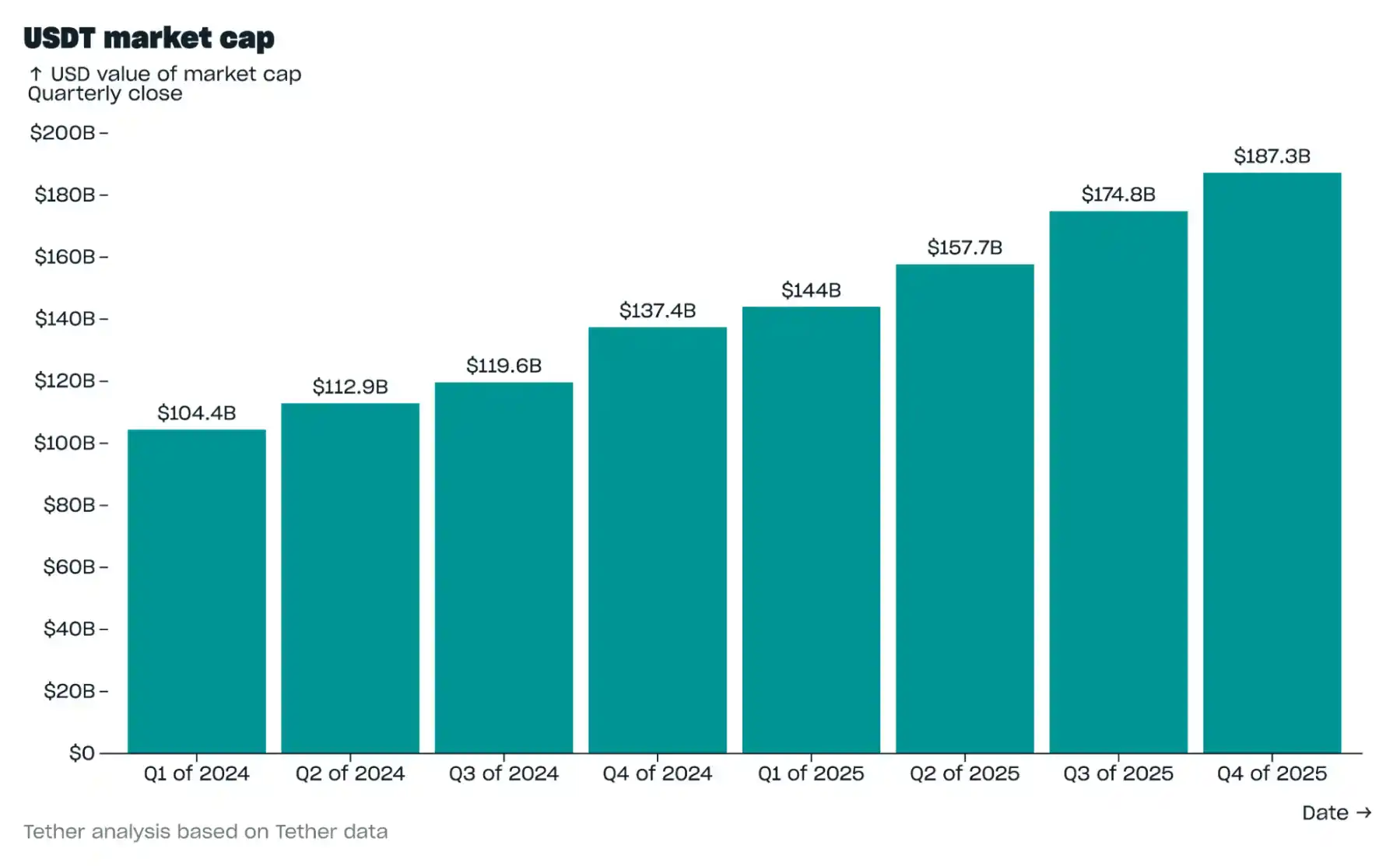

Market Capitalization

In Q4 2025, the USDT market cap grew by $12.4 billion, reaching $187.3 billion. The month-over-month growth rate in October was 4.9%, but its growth pace slowed after the cryptocurrency liquidation wave on October 10.

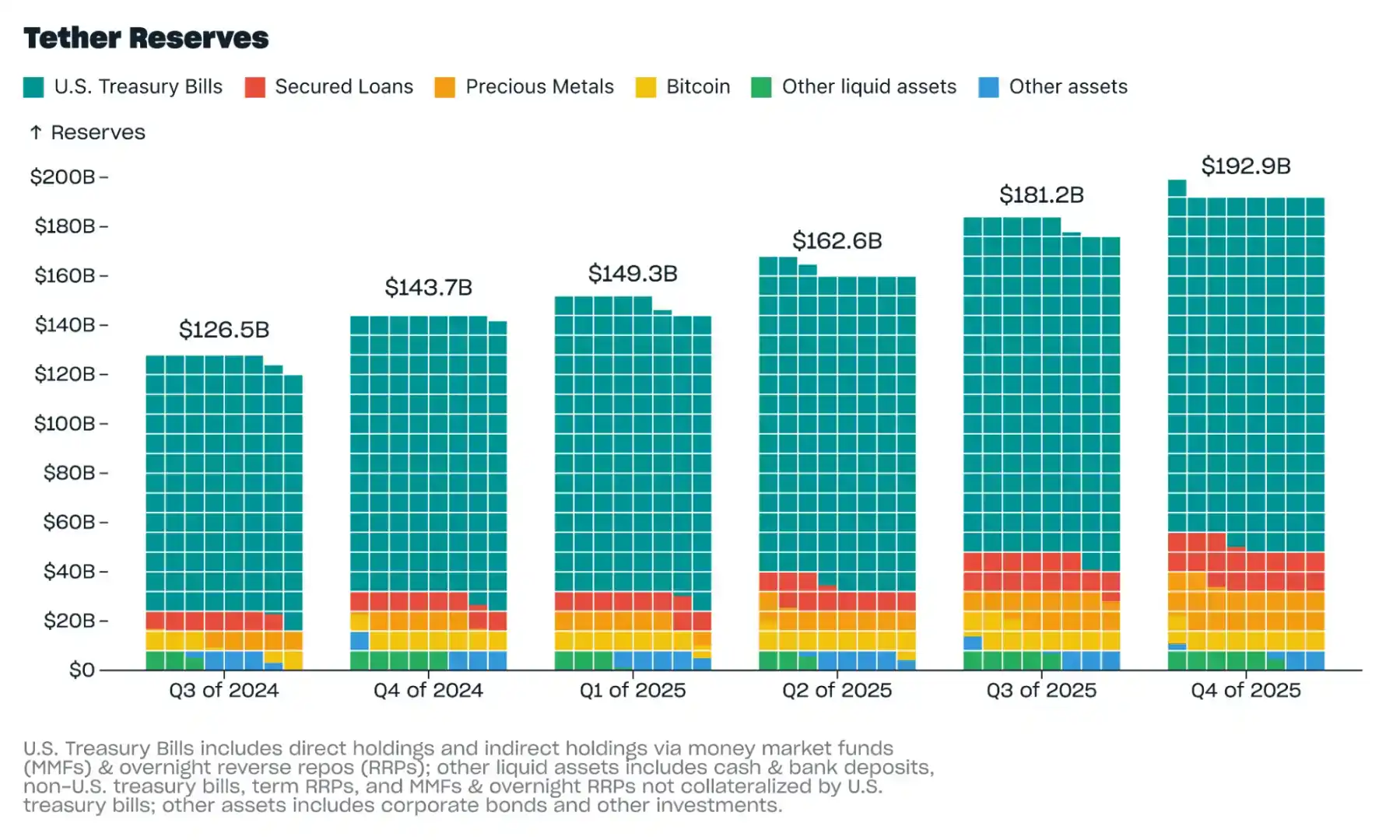

Reserves

In Q4 2025, Tether's total reserves increased by $11.7 billion, reaching $192.9 billion, with net equity (assets exceeding liabilities) of $6.3 billion. The total reserves include 96,184 Bitcoin (9,850 added in Q4) and 127.5 metric tons of gold (21.9 metric tons added in Q4).

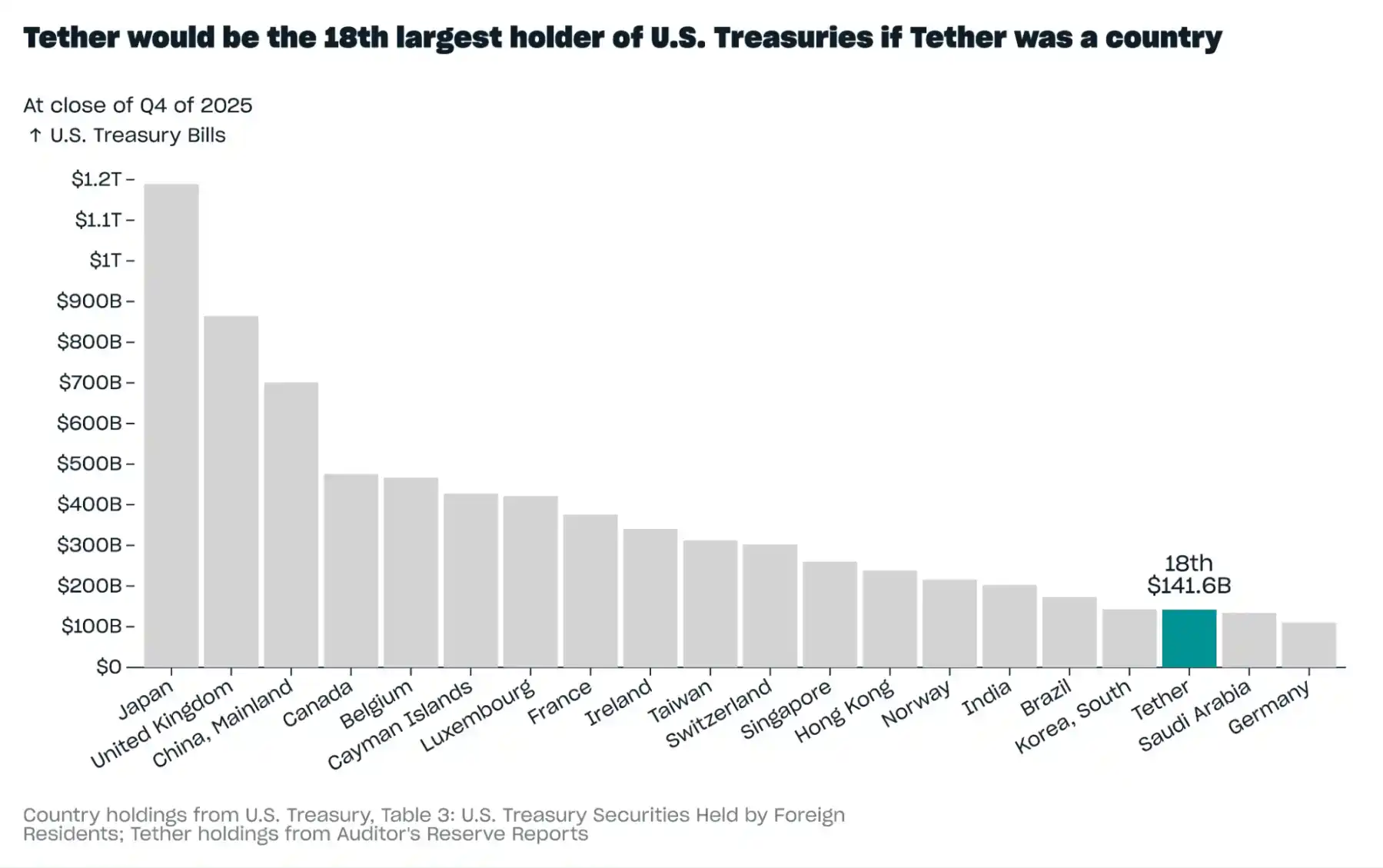

In Q4, Tether's total holdings of U.S. Treasury Bills increased by $6.5 billion, reaching $141.6 billion. If Tether were considered a "country," its holdings of U.S. Treasury Bills would rank 18th globally, surpassing Saudi Arabia and Germany.

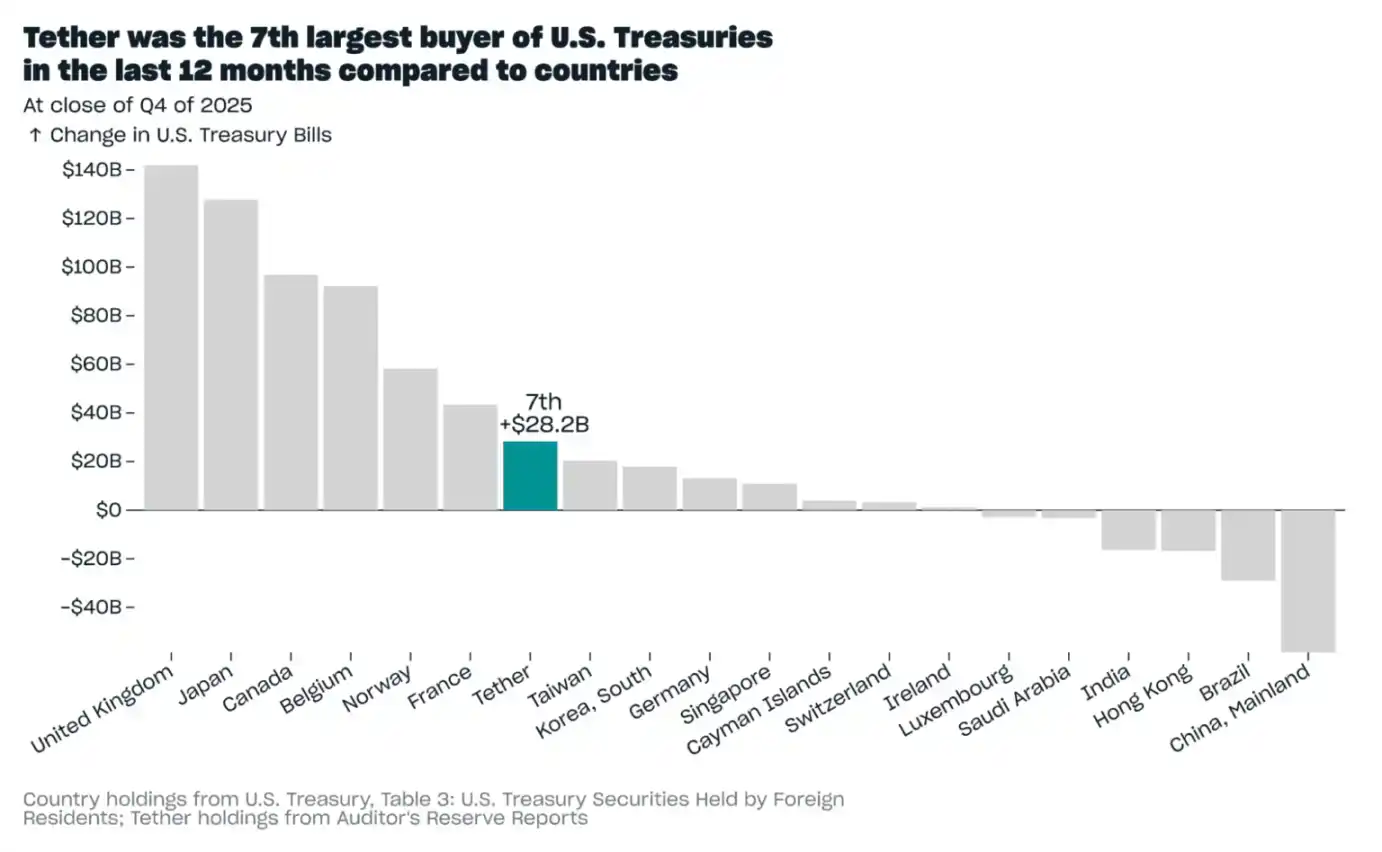

Throughout 2025, Tether accumulated an additional $28.2 billion in U.S. Treasury Bills. Over the past 12 months, compared to the accumulation by countries, Tether became the seventh largest buyer of U.S. Treasury Bills, purchasing more than Taiwan and South Korea.

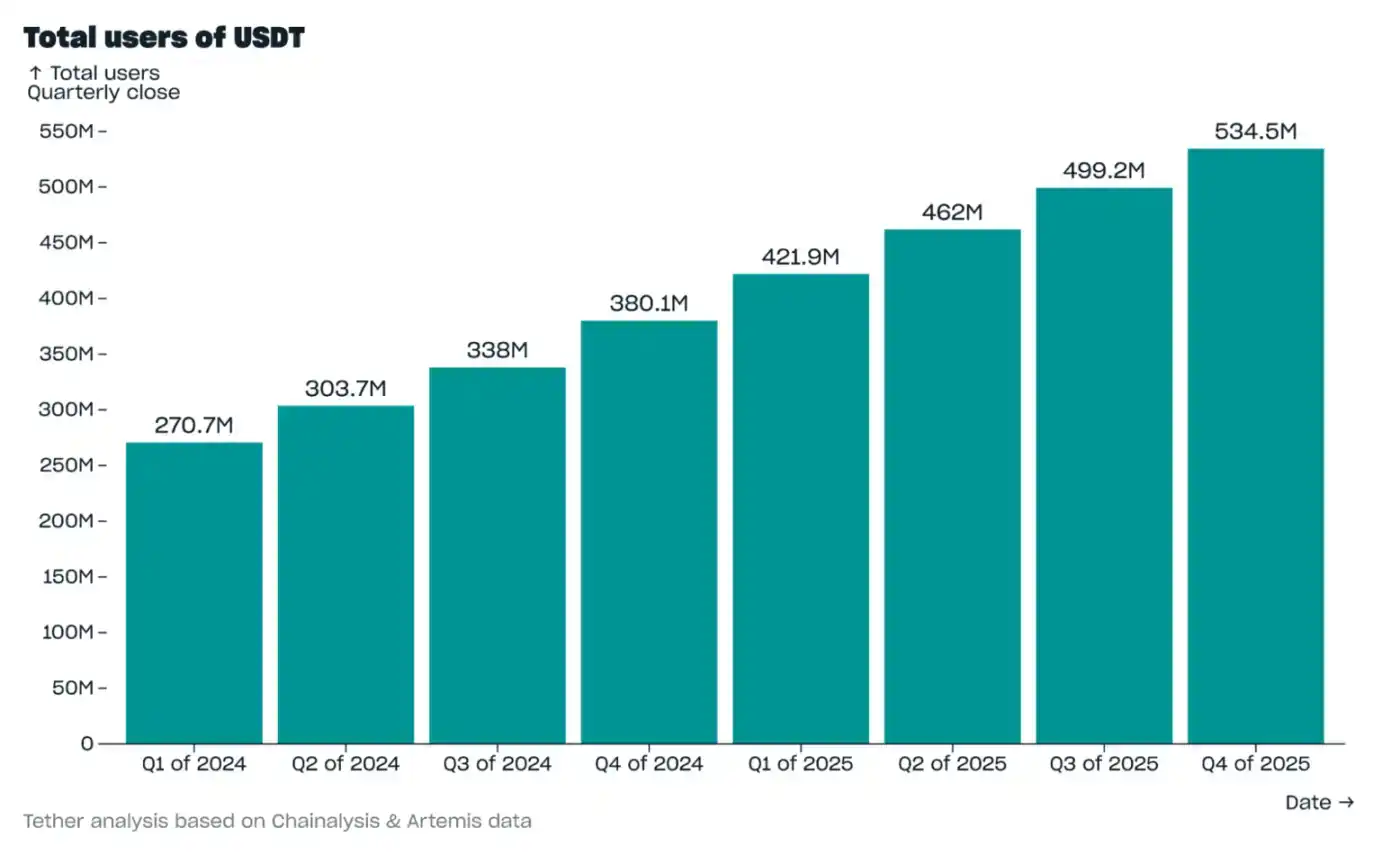

Total Users

In Q4 2025, the estimated total number of USDT users increased by 35.2 million, reaching 534.5 million. This marks the eighth consecutive quarter of growth exceeding 30 million users for this stablecoin. The user count here includes two parts: on-chain wallet users (those who have received USDT and held it for at least 24 hours) and the estimated number of users receiving USDT on centralized service platforms (such as cryptocurrency exchanges).

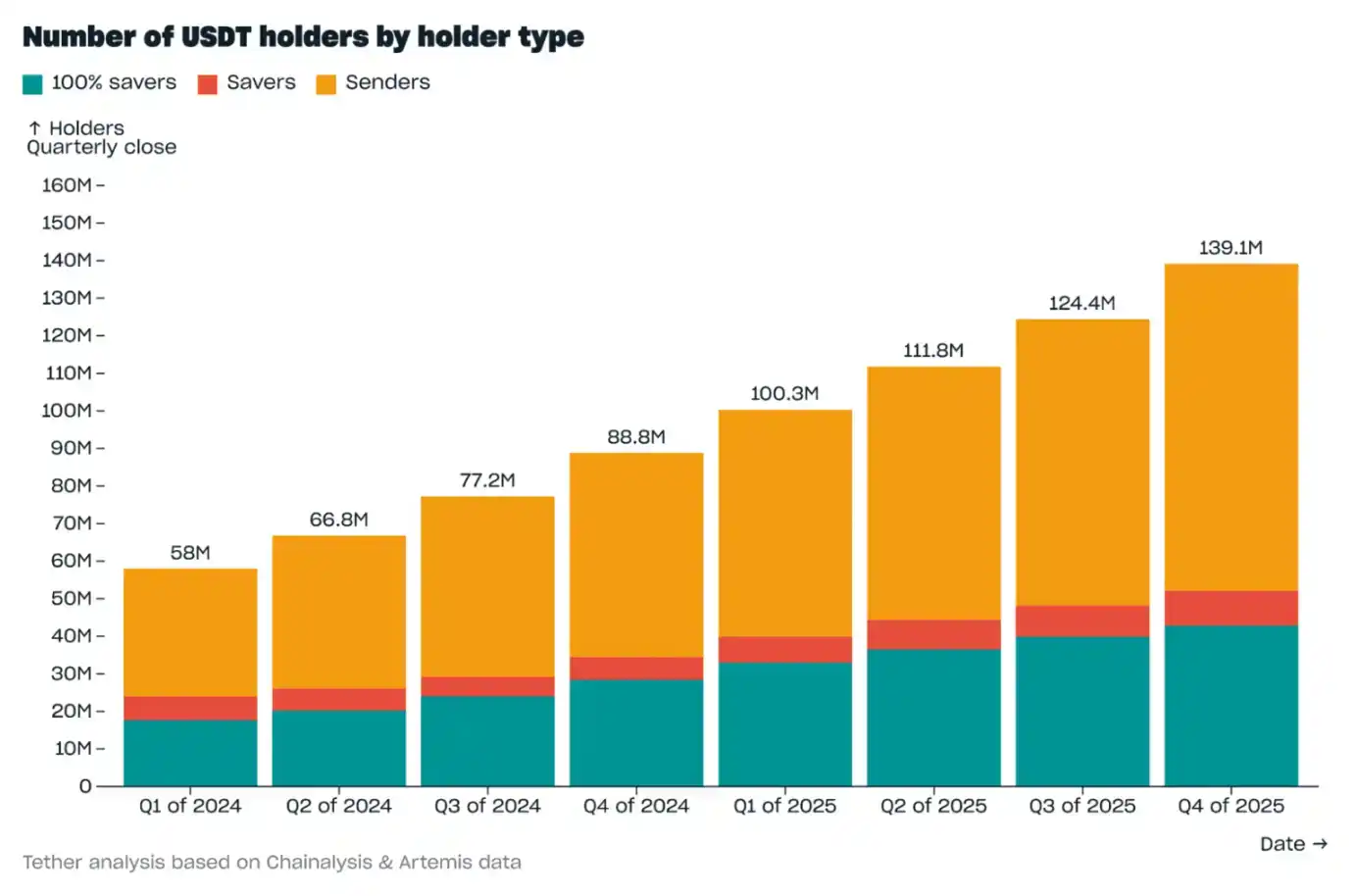

On-Chain Holders

In Q4 2025, the number of on-chain wallet users holding USDT increased by 14.7 million, reaching a total of 139.1 million, setting a new quarterly growth record. Wallets holding USDT account for 70.7% of all wallets holding any stablecoin. In addition to on-chain wallet users, it is estimated that over 100 million users hold USDT on centralized service platforms like exchanges.

The structure of USDT on-chain holders remained relatively stable, distributed as follows:

· "Pure Savers" (wallet users who retain 100% of received USDT): 30.8%;

· "Savers" (wallet users who retain on average less than 100% but more than 2/3 of received USDT): 6.7%;

· "Transactors" (wallet users who retain on average less than 2/3 of received USDT): 62.6%.

Compared to all other stablecoins, USDT has a higher proportion of "Savers" and "Pure Savers" (37.5% for USDT vs. 30% for other stablecoins collectively). Among all stablecoin savings wallets, 75.1% choose to hold USDT, indicating that USDT remains the preferred stablecoin for wealth storage.

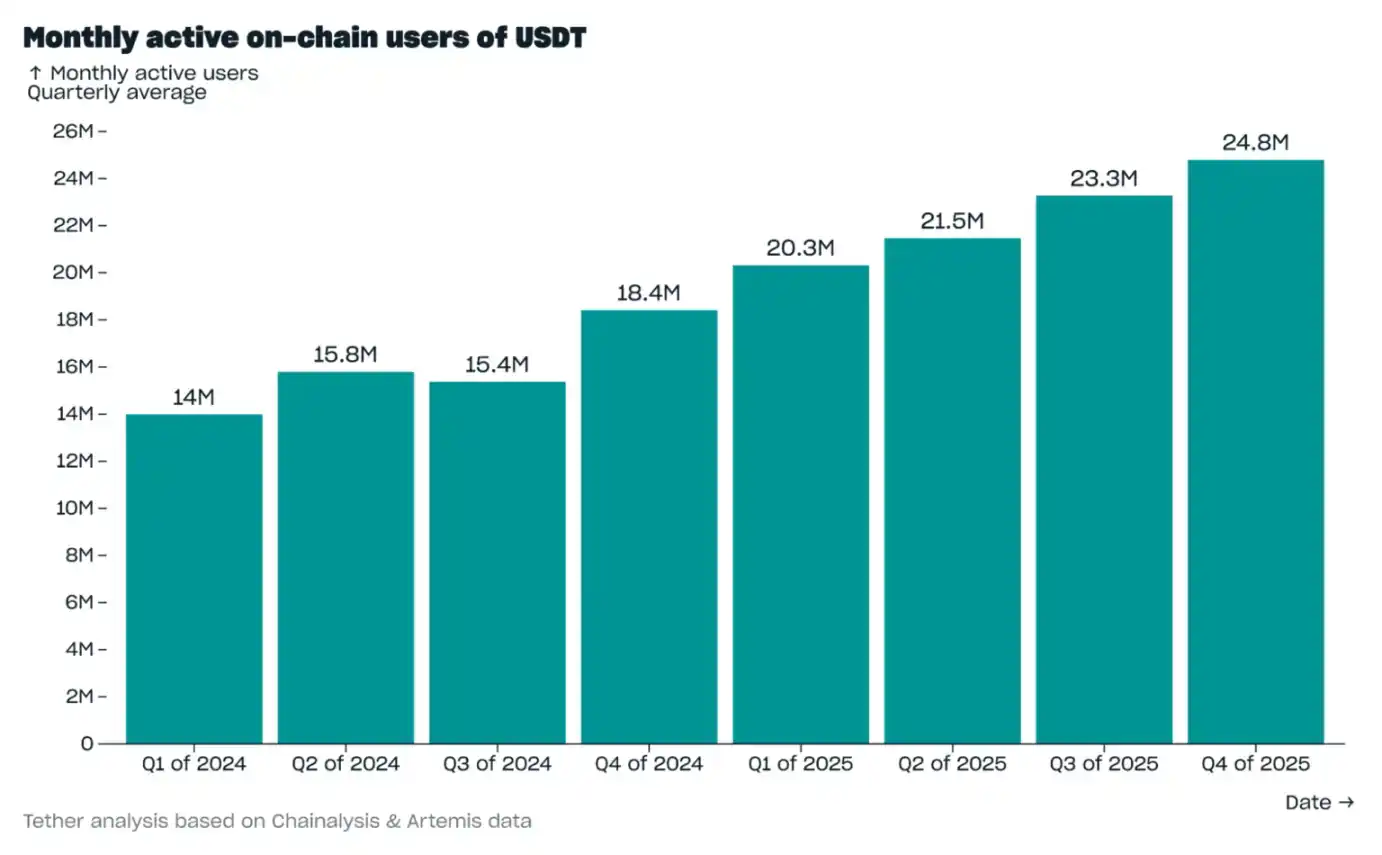

On-Chain Active Users

In Q4 2025, the average number of monthly active on-chain users for USDT (wallet users who received USDT at least once in a 30-day rolling period) reached 24.8 million, an all-time high, indicating continuously improving user activity. This number represents 68.4% of the total monthly active users for all stablecoins.

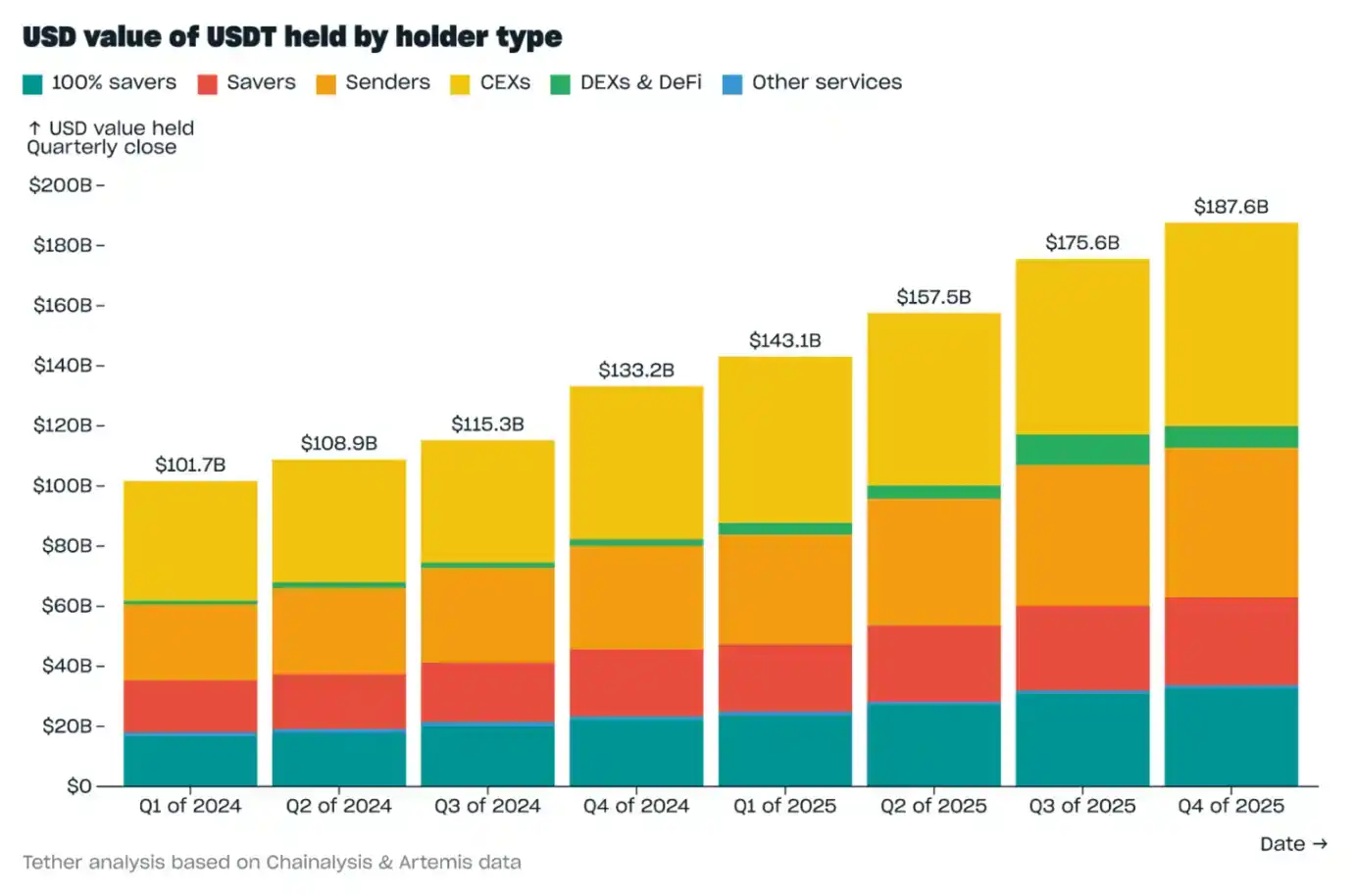

Holdings Distribution by User Type

As of the end of Q4 2025, 36% of USDT holdings were concentrated on centralized exchanges (CEXs), an increase of 2.8 percentage points from the end of Q3. This change was partly due to a decrease in USDT holdings on decentralized exchanges (DEXs) and decentralized finance (DeFi) platforms following the October 10 cryptocurrency liquidation wave: in Q4, USDT on DEXs and DeFi platforms decreased by $3 billion (a 2 percentage point drop in share) to $7.1 billion, accounting for 3.8% of total USDT holdings.

The second largest share of holdings belongs to Savers, accounting for 33%, with "Pure Savers" holding 17.4% and other "Savers" holding 15.6%. In Q4, Savers' USDT holdings increased by $2.9 billion, reaching a total of $62.1 billion by the end of the quarter. As mentioned earlier, USDT not only attracts the most Savers but also stores the highest USD value: it accounts for 59.9% of the savings value across all stablecoins; if wallets holding over $10 million (which are mostly exchange cold wallets) are excluded, USDT's share rises to 77.3%.

"Transactors" ranked third in holdings share, at 26.5% as of the end of Q4. This share remained relatively stable from Q3 to Q4, and the holdings of "Transactors" increased by $2.2 billion, reflecting USDT's continued growth in liquidity for transactional use cases.

Note that the total holdings figure here is slightly higher than the USDT market cap because total holdings include USDT in Tether's treasury that has not yet been issued, while the market cap only calculates USDT in net circulation.

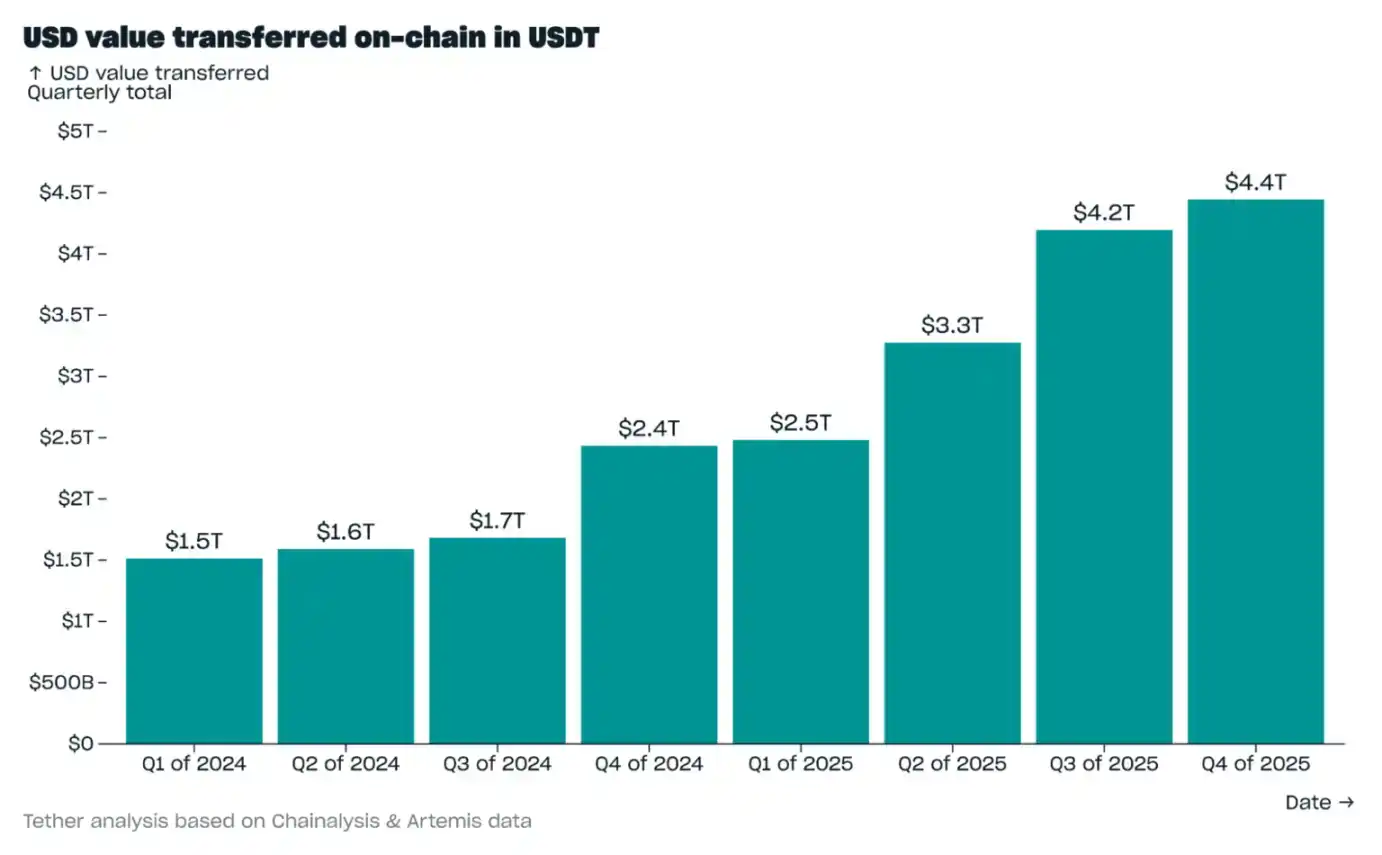

On-Chain Transfer Value

In Q4 2025, the quarterly on-chain transfer value of USDT increased by $248.6 billion, reaching $4.4 trillion, an all-time high. Of this $4.4 trillion quarterly total transfer value, $2.8 trillion (63.6%) were transfers involving only USDT, and $1.6 trillion (36.4%) were transfers involving multiple assets (these often occur in DeFi swap scenarios).

USDT's share of value in single-asset stablecoin transfers was 65.9%; its share in multi-asset stablecoin transfers was 34.6%. This data indicates that USDT remains the preferred stablecoin for value transfer, while other stablecoins are more often used for value exchange, often with USDT as the counterparty.

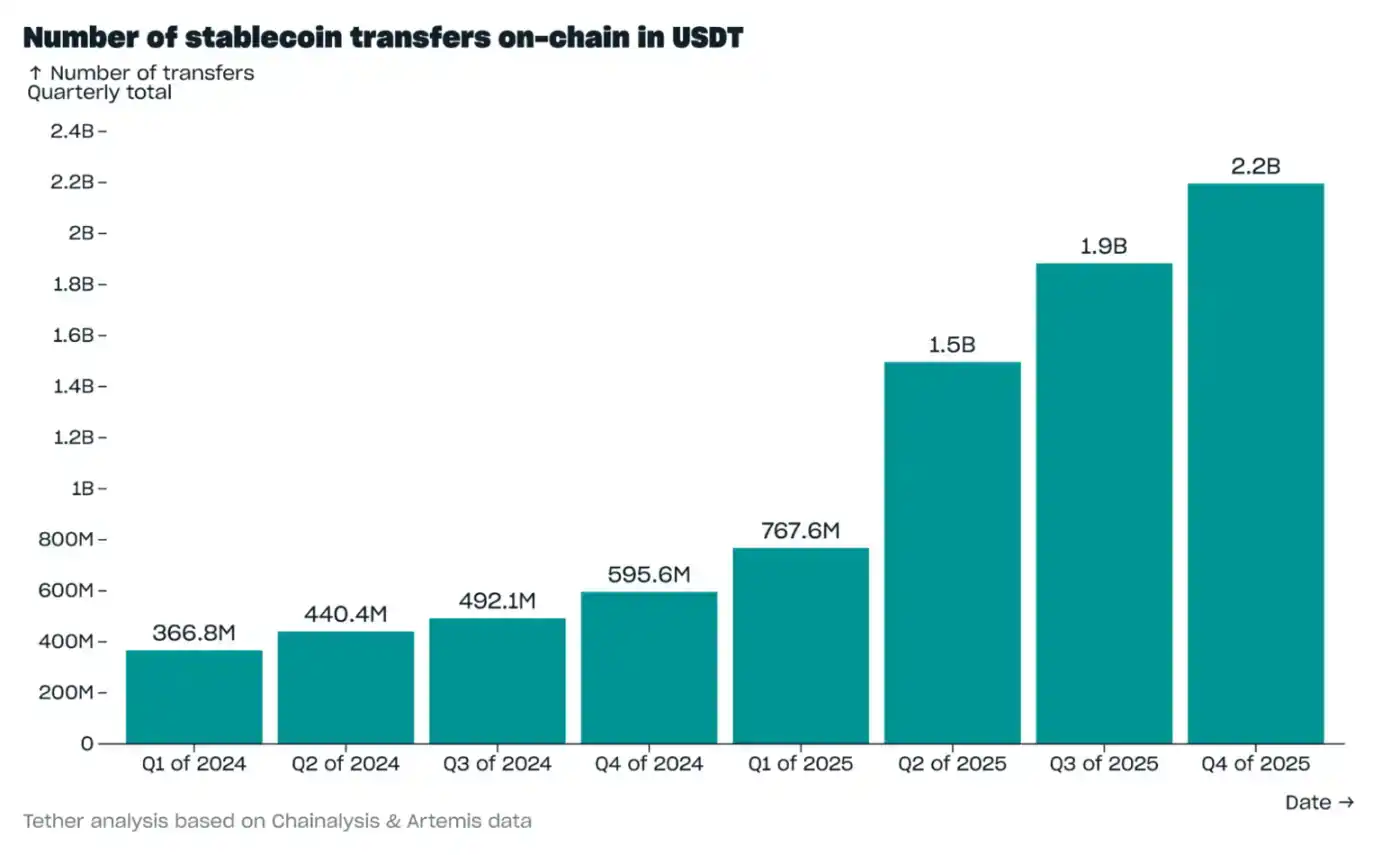

On-Chain Transfer Count

In Q4 2025, the quarterly count of on-chain USDT transfers increased by 313.1 million, reaching 2.2 billion, an all-time high. Of these 2.2 billion total quarterly transfers:

· 1.94 billion transfers (88.2%) were for amounts below $1,000;

· 256 million transfers (11.6%) were for amounts between $1,000 and $100,000;

· 4.6 million transfers (0.2%) were for amounts over $100,000.

Velocity

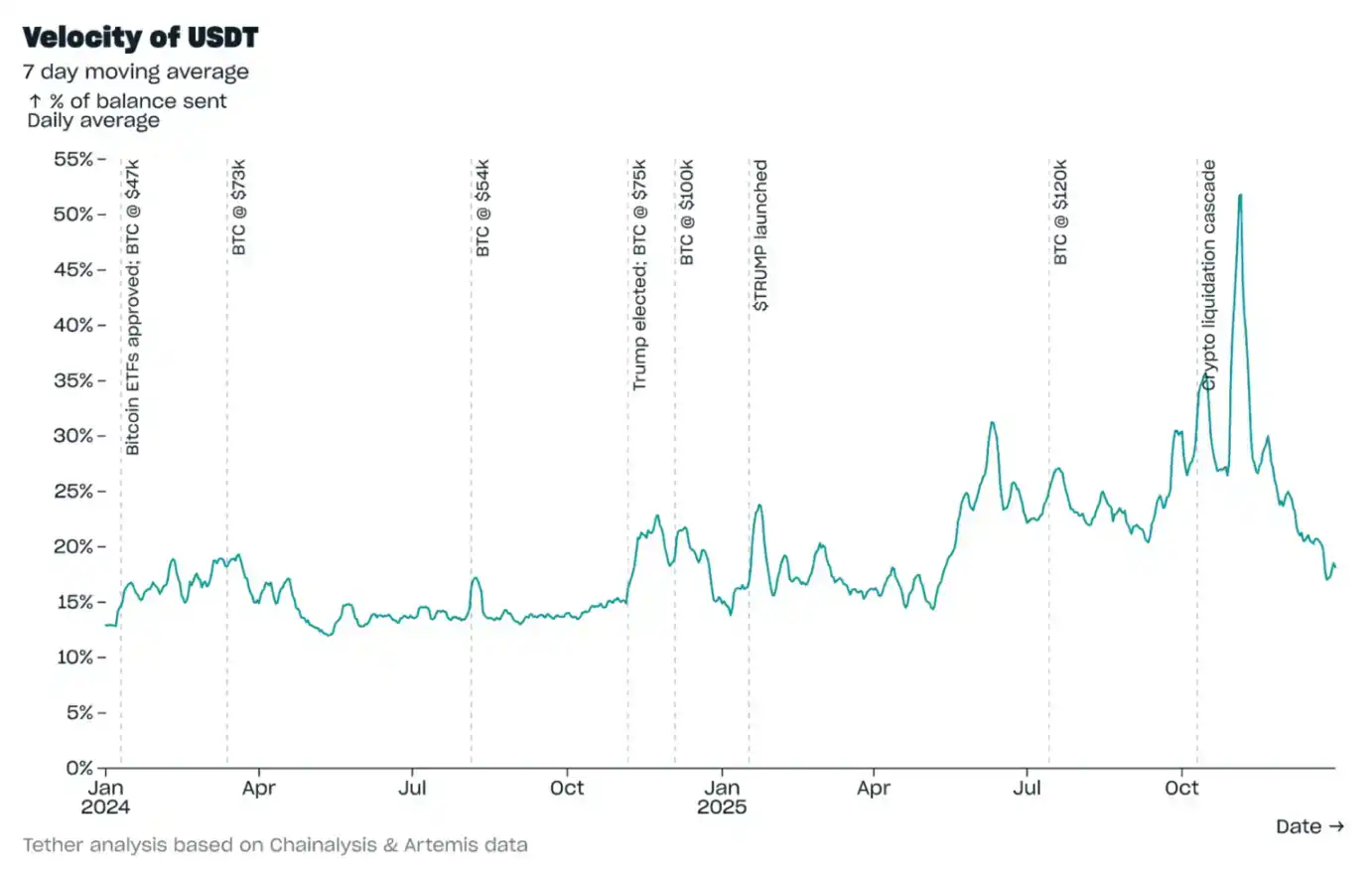

As of the end of Q4 2025, calculated on a 7-day moving average, USDT's velocity (daily transfer value as a percentage of total holdings) was 18.2%. This is lower than the peak of 51.8% on November 5 (driven by a surge in DeFi activity) and is similar to levels seen prior to Q2 2025 (when Bitcoin prices were similar to this quarter).

The average velocity for USDT in Q4 was 28%, significantly lower than the 151% velocity of the second-largest stablecoin by market cap. USDT's relatively lower velocity indicates a user base with stronger stickiness, higher stability, and, as discussed later, more diverse use cases.

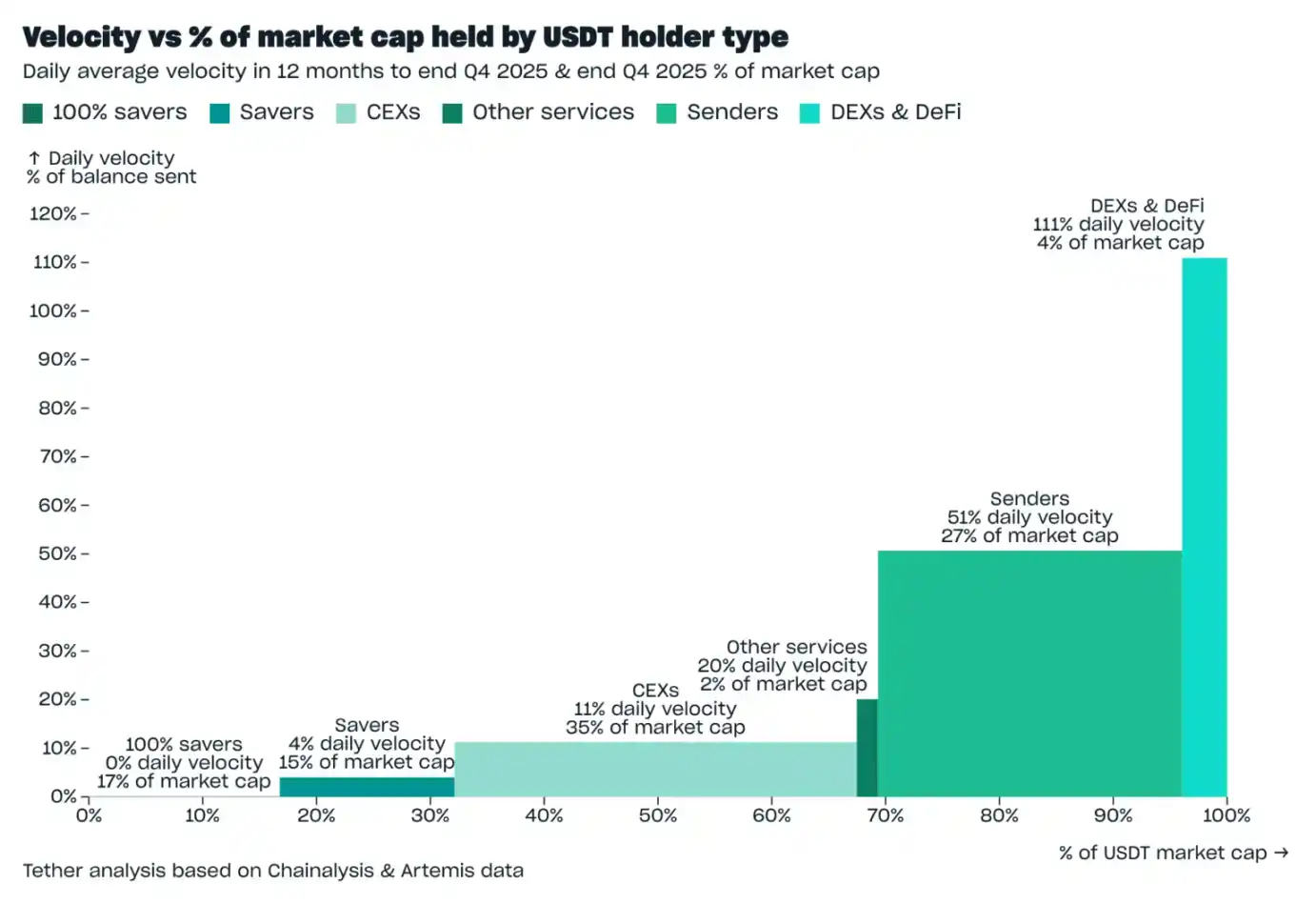

USDT's velocity naturally varies by use case: users holding USDT for savings purposes have lower velocity (as they typically hold rather than transfer). The velocity for "Pure Savers" is naturally 0, while the average daily velocity for "Savers" in 2025 was 4%.

On-chain velocity for centralized exchanges is also low, with an average daily velocity of 11% in 2025. This is because users hold USDT on exchanges for both potential savings and trading—but as the next section will mention, trading volume on exchanges is recorded on centralized order books, not on the blockchain, so the amount of USDT transferred on-chain out of centralized exchanges is low relative to the USDT holdings on those exchanges.

Use cases with higher USDT velocity include:

· "Transactor" wallets: Average daily velocity in 2025 was 51%. These wallets transfer USDT for various purposes, including payments, remittances, moving funds between exchanges, etc.;

· DEX and DeFi platforms: Average daily velocity in 2025 was 111%. Velocity in these scenarios is typically very high because DEX trades are recorded on the blockchain, and users may execute multiple trades in a single day, ultimately resulting in velocity exceeding 100%.

67% of USDT's market cap is distributed in low-velocity scenarios, and 33% in high-velocity scenarios. This distribution ensures stability through low-velocity scenarios and liquidity through high-velocity scenarios.

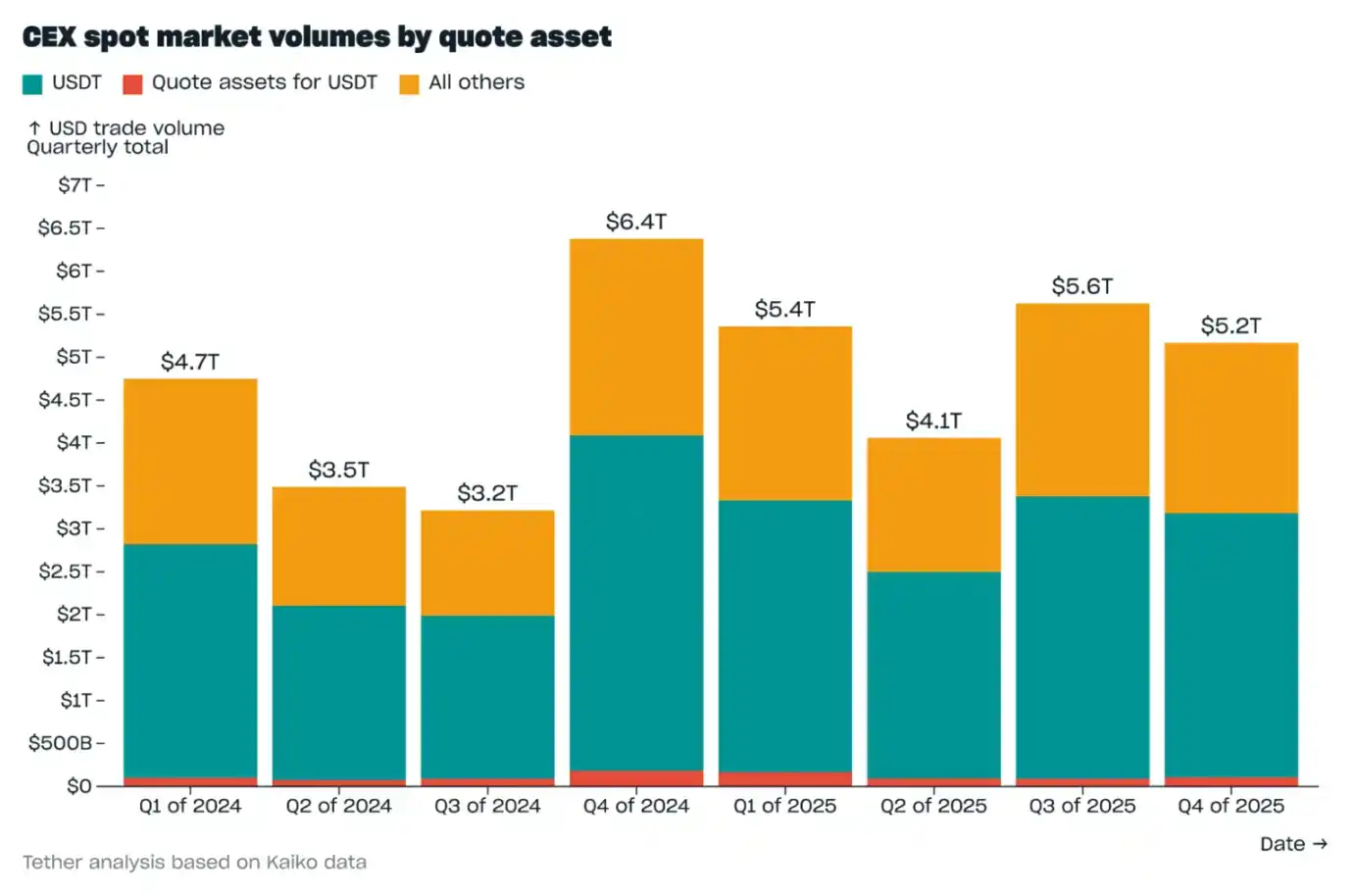

Spot Market

In Q4 2025, the spot trading volume for USDT on centralized exchanges was $3.2 trillion, of which 96.5% had USDT as the quote asset, and the remainder had other assets quoted against USDT. Affected by the October 10 cryptocurrency liquidation wave, volume decreased by 5.9% compared to Q3. However, since the trading volume of all other assets decreased by 11.5% compared to Q3, USDT's share of the total spot market trading volume反而 increased by 1.5 percentage points, reaching 61.5%.

In Q4, the number of USDT spot trades was 14.1 billion, accounting for 80% of all spot trades in the quarter.

Conclusion

In Q4 2025, USDT achieved numerous all-time highs, although growth slowed after the October 10 cryptocurrency liquidation wave. However, the data indicates that the cryptocurrency market is not the sole driver of USDT's growth.

Compared to other stablecoins, user preference for saving in USDT is significantly higher (USDT accounts for 75% of all stablecoin savings wallets; and 77% of the savings value in wallets holding less than $10 million), providing USDT with a stable, low-velocity source of demand.

In high-velocity use cases as a medium of exchange, USDT also leads: it accounts for 65.9% of the value in single-asset stablecoin transfers and 34.6% in multi-asset stablecoin transfers. This phenomenon indicates that USDT remains the preferred stablecoin for value transfer, while other stablecoins are more often used for value exchange (often with USDT as the counterparty). These high-velocity use cases provide ample liquidity for USDT, ensuring its wide availability and acceptance.